Nussbaum Transportation, a 300-unit fleet based in Illinois, has enjoyed relatively low turnover for a truckload carrier – between 30 and 40 percent, compared to an industry average that hovers around 100 percent for TL. With good word of mouth from satisfied drivers, hiring new drivers has typically not been a problem. But last summer, the usually steady pipeline of qualified drivers came to a halt.

After growing by about 50 drivers over the previous year, in July “it just kind of hit a wall,” explains Jeremy Stickling, director of human resources. From July through October, Nussbaum’s driver fleet numbers remained flat. “It’s not that we were hemorrhaging drivers. We just weren’t getting the number of quality candidates we were used to.”

Anectodal evidence suggests that Nussbaum isn’t the only company that has begun to struggle to get drivers after years of enjoying low turnover. Even some less-than-truckload carriers and private fleets, which traditionally have turnover around 10-15 percent, have had to get more creative and work harder to fill the seats behind the wheel.

It’s a similar situation with dedicated fleet operations.

“Traditionally it’s been easier to hire into dedicated fleets,” says Craig Brown of Arkansas-based flatbed carrier Maverick Transportation. “We used to be able to attract younger people to dedicated fleets, because of the more predictable schedule. But we’re even finding that’s much more difficult this year.”

As an industry, trucking faces a massive labor shortage in the coming years. The industry is currently short about 35,000 truck drivers, and we’ll need nearly 240,000 additional drivers by 2020, according to the American Trucking Associations’ estimates.

Competing with other businesses

Other business sectors face labor and skills shortages of a similar magnitude.

The Bureau of Labor Statistics offers a list of occupations with the most job growth between 2012 and projected out to 2022. Heavy truck drivers are on the list, but the projected shortfall of drivers ranks near the bottom quarter of the list at 11.3%. Sitting above truck drivers on the list are construction workers (24.3%), home health care aides and personal care workers (48%), nurses (24.8%) and software developers (22.8%), for example.

By employment group, projected growth for workers in transportation and material handling occupations is quite close to the bottom compared to other sectors, such as healthcare support occupations (28%), computer and mathematical occupations (18%) and construction and extraction jobs (21%).

The training or education required for entry into some of these fields is comparable to trucking. Wages, based on 2012 figures, are comparable in most cases. So trucking probably wouldn’t stand out in the eyes of a young person scanning such a list while planning his or her career.

“We’ve tried bonuses … we’ve set up driver training schools, we’ve tried to get people home more regularly, we’ve bought bigger nicer trucks, and still the problem gets worse and worse.”

You can bet, too, that these other occupations will be competing vigorously for the pool of available workers, with wages, benefits and other perks. Trucking will be competing against some decent-paying, easy-to-enter occupations with considerably more attractive lifestyle options.

There have been articles about the challenges of finding good drivers as long as there have been trucks and trucking magazines, but several factors are at play in today’s industry that are changing the dynamics of the industry’s driver problem, including demographics and increased regulations.

Demographics

“What we’re seeing with drivers as well as with technicians is that more and more folks are reaching retirement age, and the next generation are not coming out in the quantities that we need,” says Jane Clark, who as vice president of member services at Nationalease works with many of its 165 truck leasing company member companies on driver recruiting and retention. “There’s a gap, and the gap’s growing wider.”

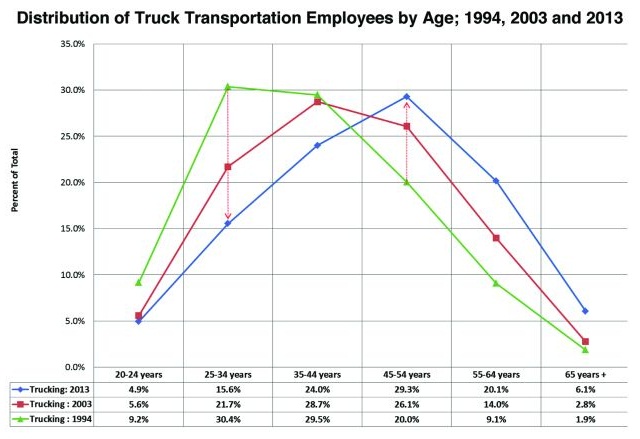

The median driver age has risen significantly over the past two decades, according to a new paper released by the American Transportation Research Institute, the research arm of the American Trucking Associations.

The ATRI found that the trucking industry was disproportionately dependent on employees 45 years of age or older. At the same time, there has been a sharp decrease in drivers age 35 and younger.

The median truck driver age in 2013 was 46.5 years old, versus 42.4 for the overall U.S. workforce. Private carriers skewed older still, with a median driver age of 52 years old.

“The average age of our current driver workforce is 52, and we’re noticing fewer and fewer younger individuals applying for jobs in recent years,” says Keith Tuttle, founder of Motor Carrier Service, an Ohio-based truckload and logistics provider, and member of the ATRI research advisory committee.

Despite the driver shortage, younger prospects are not joining the industry, making the looming retirement of a large portion of the workforce more alarming to carriers.

A federal requirement that an interstate commercial driver’s license holder be at least 21 years old is often cited as one of the biggest obstacles to attracting younger drivers. The age requirement leaves a three-year post-high school gap that may prevent young people from considering a career in trucking.

Kevin Burch, president of truckload carrier Jet Express in Dayton, Ohio, expresses frustration over rules that mean a 19- or 20-year-old working for his company can “drive between Dayton and Toledo, 165 miles up I-75, one of the busiest Interstates, yet he can’t go down to Cincinnati, which is 58 miles, or Richmond, Indiana, which is 28 miles.”

Another problem with attracting younger workers is that in an age where many more young people are pushed toward a college education rather than vocational schools or other blue-collar work, few families are urging their children to consider truck driving as a career.

In addition to looking for ways to appeal to younger drivers, many fleets are trying to expand the pool of drivers beyond the traditional demographics. Policies, equipment specifications and advertising are being designed to attract more women and minorities.

Some fleets are actively working to help recently returned veterans convert experience driving in military convoys in the Middle East to the skills needed for domestic truck driving.

There’s also hope that President Obama’s move to let some undocumented immigrants stay in the country could clear the way for them to become professional truck drivers, but that path is neither simple nor quick.

Regulatory changes have made the driver problem worse in two ways. Some regulations, such as changes in hours of service rules regulating how long drivers can work each day and week, have cut fleet productivity, requiring more drivers to move the same amount of freight. Others have made it harder for drivers to get into or stay in the industry, and have eaten away at the independence of the job that was traditionally one of long-haul trucking’s appeals.

John Larkin, transportation analyst with investment firm Stifel Nicolaus, says the “real driver-driven capacity crunch” may come in the 2016-2017 time frame when the electronic log mandate is expected to go into effect, along with an expected regulation requiring speed limiters in the U.S.

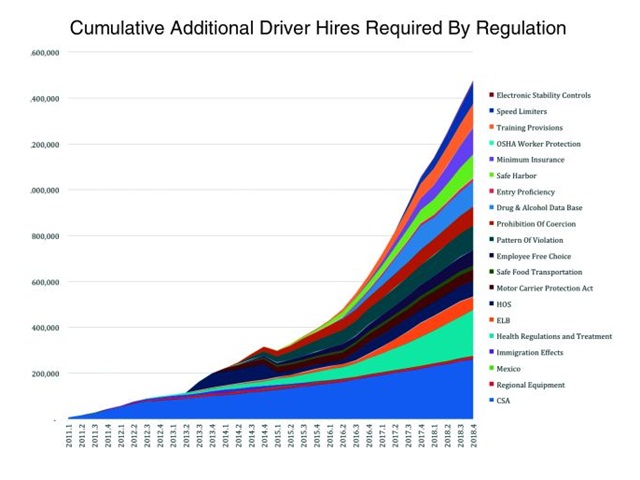

For instance, Noel Perry, truck and transportation expert with the transportation research and analysis firm FTR, says the number of additional driver hires resulting from health regulations and treatment could top 200,000 between 2011-2018, while the Compliance, Safety, Accountability enforcement program could mean nearly 262,000 more drivers.

“For being a deregulated industry, we’ve got a lot of regulations,” Burch says. “And we are safer than what we were 10 years ago. But we’ve got so many [new] rules and regulations applied to drivers who have been hauling freight safely for years that they’re getting to the point where they say they’re going to get out of the business.”

The rapid pace of new rules, and rules that are being reviewed and challenged and “tweaked,” creates a lot of uncertainty and confusion among drivers, he says.

“I guess I call it the hassle factor,” Burch says. “When you look at all the things you’ve got to overcome to get into the industry, it’s tough.”

Pay

There has been much discussion over the years about whether drivers are paid enough. After all, private fleets and less-than-truckload fleets, which have lower driver turnover, typically pay more.

Last year saw a rash of driver pay raise announcements. Big truckload fleets such as USA Truck, Swift, Werner and U.S. Xpress all announced significant pay increases, notes Donald Broughton of Avondale Partners, an investment advisory firm. Many midsize companies, such as Nussbaum and Alabama-based Boyd Brothers, did the same.

“Everyone out there is either dealing with unseated trucks or paying drivers significantly more,” Broughton says.

But some are questioning how important pay really is.

New data released last month by the American Trucking Associations showed that median pay for drivers was on par with the national media for all U.S. households, and that the industry offers drivers “competitive” benefits.

The study of 130 fleets and more than 130,000 drivers found that median pay for drivers ranged from just over $46,000 for national, irregular route dry van truckload drivers to more than $73,000 for private fleet van drivers.

“As the economy grows, we are seeing an ever-more-competitive driver market,” says Bob Costello, chief economist for ATA.

But many say pay can only go so far in solving the problem.

“For years, a lot of surveys showed pay was the number one issue [among drivers]. I’ve never believed that,” Burch says. “Everybody wants to be paid more. But it’s not all about money; it’s about lifestyle, it’s about dignity, respect, and honesty.”

Stifel’s John Larkin notes, “We’ve tried bonuses … we’ve set up driver training schools, we’ve tried to get people home more regularly, we’ve bought bigger nicer trucks, and still the problem gets worse and worse. I’m in the camp that says taking pay up is not the answer. There are many carriers who pay 75, 80 thousand dollars who have just as hard a time finding drivers as those paying 35 or 40.”

Clark says while better pay may help get people in the door, it’s not the top factor when it comes to retention.

“When you read literature on employee engagement, pay is never the number one reason people leave a company,” she says.

|

What is employee engagement? Aside from the mortgage payment, it’s what makes you want to get up for work in the morning. Or, in this context, it’s what keeps drivers from jumping ship over some minor irritation.

Engagement, or how emotionally committed employees are to an organization and its goals, can have a direct correlation to profitability. As engagement scores go up, typically so does productivity, while turnover goes down.

Pay can be a component of engagement programs, but higher wages don’t tend to affect engagement on their own. A 2013 Gallup report, involving interviews with 1.4 million employees from 192 organizations across 49 industries and 34 countries, indicated no significant difference in employee engagement by pay level.

Engagement can be a challenge when you’re dealing with truck drivers. You’re dealing with a solitary work environment and communications that are largely limited to electronic messages and occasional phone calls.

In fact, the long-haul lifestyle, with drivers out two or three weeks at a time with little to no guarantee of when they may be home, has been considered a major factor in the driver shortage.

In response, larger fleets especially have moved into more regional and dedicated-fleet areas where they can offer drivers more home time and more predictable schedules.

Successful fleets are taking extra steps to improve the engagement of their drivers.

For instance, in addition to its recent pay increase, Nussbaum implemented a program where each manager gets assigned a driver name once a week to call and simply ask about concerns and suggestions.

The larger picture

One of the toughest challenges to overcome is the fact that most people don’t view truck driving as a desirable job.

“Most Millennials are college graduates and would rather be a Starbucks barista or a teacher, but under no circumstances do they want to be a truck driver,” says Stifel’s Larkin.

Kevin Burch likes to start discussions on the driver shortage by asking members of an audience to raise their hands if they would like their children to grow up and work as drivers. Few typically raise their hands – and this is in an audience that is already in the trucking industry.

“Back in the ’50s and ’60s when we were the knights of the road, you were proud to know a truck driver. You were proud to know your family member was a truck driver,” he says. “People just don’t relate to any of that anymore.”

In addition, many of the conditions that make trucking less than desirable are out of control of the trucking companies.

“To really get to the level we need to is going to take the help of the shippers,” says Nussbaum’s Stickling, “and they don’t have the incentive we do. It’s going to be hard to get them to the table until there just aren’t any trucks.”

Some shippers are already working more closely with fleets to cut down on the irritations that make for unhappy drivers and lower productivity, such as long wait times to load and unload, in exchange for guaranteed capacity and smaller rate hikes.

“I think what we see from [fleets] that are most successful in recruiting drivers is that there’s not just a single solution,” says Nationalease’s Clark. “There’s no silver bullet.”

No comments:

Post a Comment